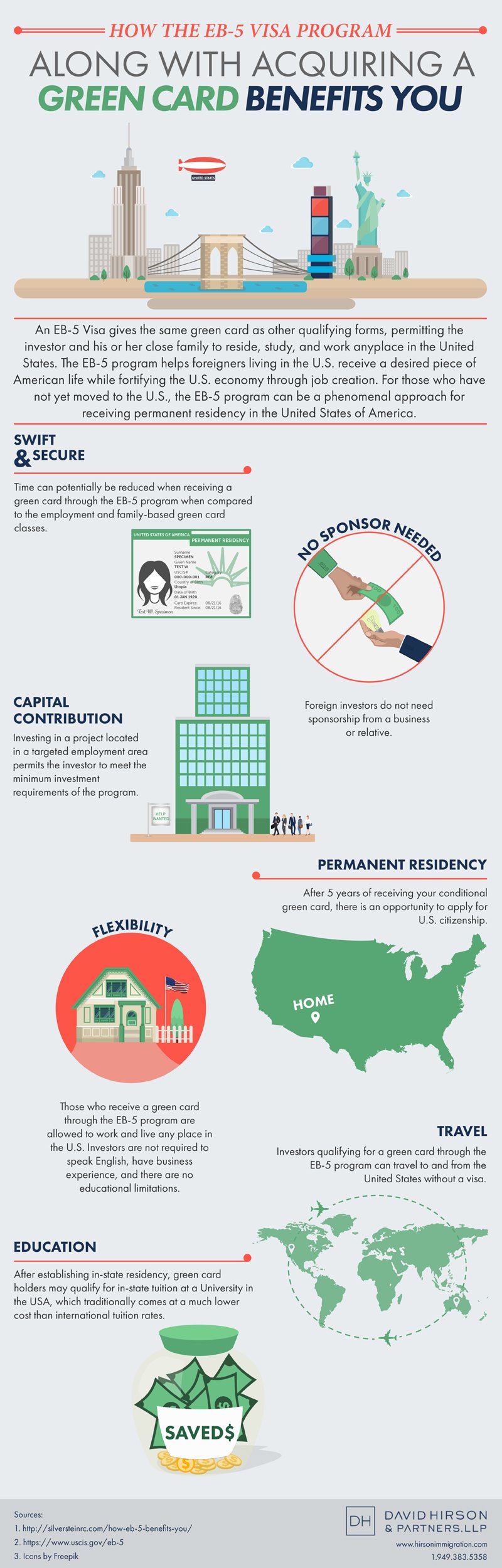

The EB5 Regional Center Program presents a compelling opportunity for international investors seeking to secure U.S. residency while contributing to the nation's economic development.

With a minimum investment of $800,000 in designated areas, participants can access a range of financial avenues that promise not only stability but also potential growth.

This program encapsulates a dual benefit-personal advancement paired with a commitment to job creation. However, understanding the nuances of eligibility and investment processes is crucial for maximizing these advantages. What implications does this have for your future aspirations?

The EB5 Regional Center Program is a U.S. immigration initiative designed to stimulate the economy through job creation and capital investment by foreign investors. Established in 1990, the program allows eligible foreign nationals to obtain a U.S. green card by investing a minimum of $1 million, or $500,000 in targeted employment areas.

These investments must be made in designated Regional Centers that focus on specific economic sectors. The program aims to attract foreign capital to promote economic growth and employment opportunities within the United States.

Investors are required to demonstrate that their investment will create or preserve at least ten full-time jobs for U.S. workers, ensuring a direct benefit to the American economy while providing a pathway to permanent residency for participants.

Investing in a Regional Center offers significant advantages for foreign nationals seeking U.S. permanent residency. One of the primary benefits is the reduced requirement for active management, allowing investors to focus on their primary responsibilities while their funds contribute to job creation and economic growth.

Additionally, Regional Centers often target high-unemployment or rural areas, which can lead to higher potential returns on investment. The pooling of resources in these centers diversifies investment risk, enhancing financial security.

Furthermore, investors can gain access to a wide array of projects, ranging from real estate developments to infrastructure initiatives. Ultimately, Regional Center investments not only facilitate the immigration process but also provide a pathway to financial opportunities in the U.S. market.

Eligibility for participation in the EB5 Regional Center Program is primarily determined by the investor's financial capacity and immigration intentions. To qualify, an investor must demonstrate a minimum investment of $800,000 in a Targeted Employment Area (TEA) or $1,050,000 in other regions.

Additionally, investors must prove that their investment funds are derived from lawful sources, which may include personal savings, business revenues, or gifts. Furthermore, applicants must be able to provide a comprehensive business plan that outlines job creation and economic impact.

It is important for potential investors to understand the various requirements and ensure they meet the necessary criteria before proceeding. Meeting these eligibility requirements is crucial for a successful application to the EB5 Regional Center Program.

Navigating the investment process in the EB5 Regional Center Program involves several key steps that investors must follow to ensure compliance and maximize their chances of approval. Initially, prospective investors should select a designated Regional Center that aligns with their investment goals and project interests.

Following this, the investor must conduct thorough due diligence to assess the center's track record and project viability. Once a suitable Regional Center is identified, the investor proceeds to invest the required $900,000 or $1.8 million, depending on the project's location.

Subsequently, the investor files Form I-526, Immigrant Petition by Alien Investor, along with supporting documentation to demonstrate the investment's legitimacy. Upon approval, investors can apply for a conditional Green Card, paving the way for permanent residency.

Numerous investors have successfully leveraged the EB5 Regional Center Program to achieve their immigration and financial objectives. One notable case involved a family from China who invested in a hospitality project in California, resulting in the creation of over 100 jobs and their eventual green card approval.

Another success story features an entrepreneur from India who funded a renewable energy initiative, which not only met the job creation requirements but also contributed to sustainable development. These examples illustrate the varied opportunities available through the program.

Investors report increased economic stability and improved quality of life, affirming that the EB5 program serves as a viable pathway to both U.S. residency and substantial financial returns, transforming their futures in meaningful ways.

As the EB5 Regional Center Program continues to evolve, a growing number of investors are turning their attention to emerging sectors that promise both job creation and sustainable returns. Notably, technology and renewable energy are capturing significant interest, with projects focusing on innovative solutions that address climate change and enhance infrastructure.

Additionally, real estate developments in urban areas are increasingly popular due to the demand for housing and commercial spaces. Investors are also prioritizing projects that align with social impact goals, reflecting a shift towards socially responsible investing.

Furthermore, regulatory changes may drive a more competitive landscape, prompting regional centers to emphasize transparency, and investor engagement, transforming the dynamics of EB5 investments in the years ahead.

If the investment does not create the required number of jobs, the investor may face significant consequences, including the potential loss of their investment and the inability to secure permanent residency. The U.S. Citizenship and Immigration Services (USCIS) evaluates job creation as a critical component of the EB-5 program. Therefore, it is imperative for investors to conduct thorough due diligence on regional centers and their projected job creation outcomes to mitigate risks.

Yes, family members can obtain visas through your investment in the EB-5 program. The EB-5 visa allows for the inclusion of immediate family members, such as spouses and unmarried children under the age of 21. This provision enables investors to not only secure their own residency but also provide their family with the opportunity for a new life in the United States, fostering a collaborative approach to immigration and investment.

The EB-5 application process typically takes between 12 to 24 months, depending on various factors including the complexity of the case and the workload of U.S. Citizenship and Immigration Services (USCIS). Initial processing of the I-526 petition may take 6 to 12 months, followed by additional time for consular processing or adjustment of status. It is advisable for applicants to engage legal expertise to navigate the intricacies and potential delays in the process effectively.