It's a good idea to consider if the amount of your estate is huge sufficient to warrant the need to cover estate taxes. Life insurance policy is likewise a method for moms and dads to make certain that their children can still most likely to college if something takes place to one or both of them. There are insurance coverage policies that will certainly accumulate money value.

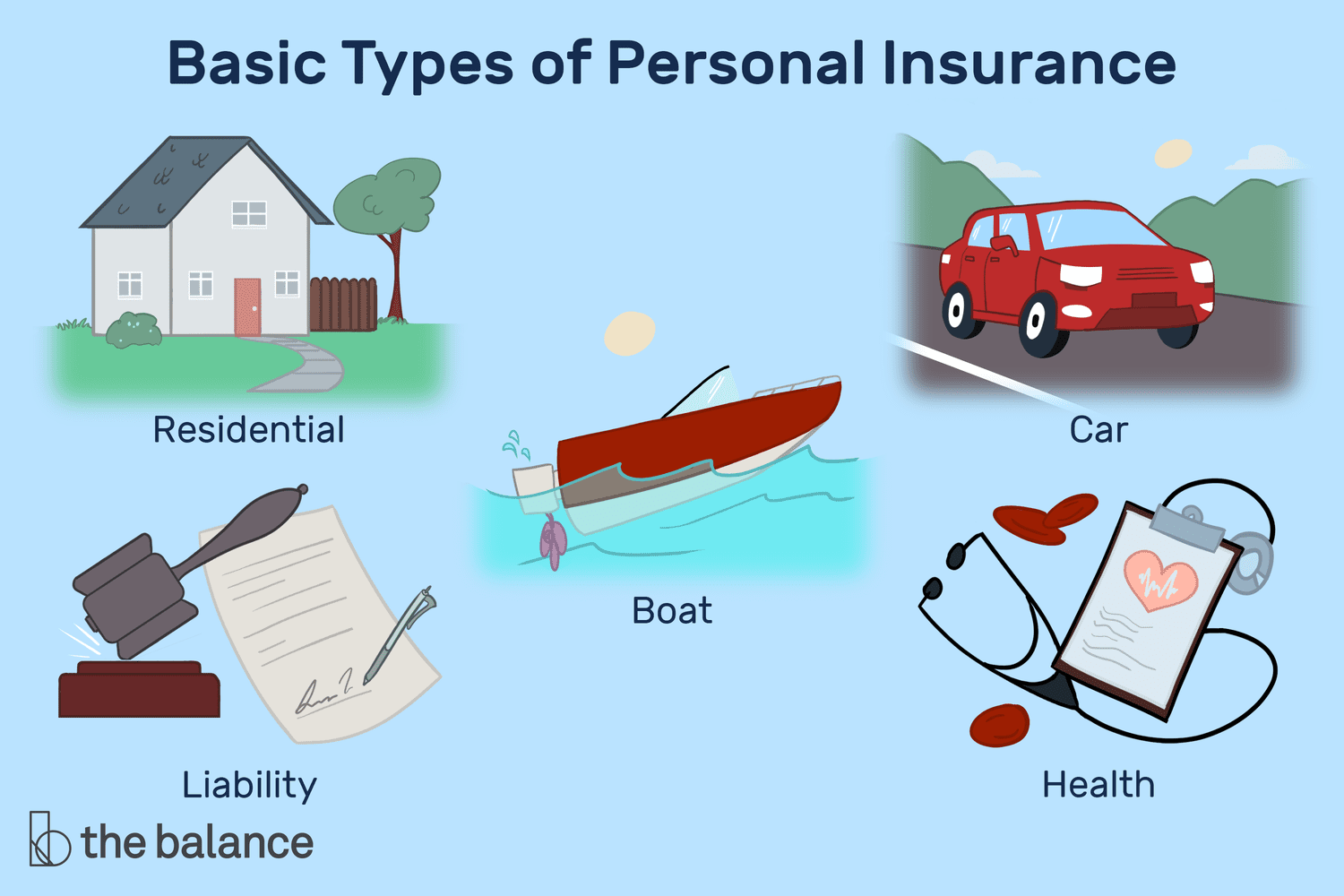

Industrial auto insurance protects your organization from the cost of damages or injuries that occur while you use an automobile for business functions. If you or among your employees is included in a crash, this insurance will cover the price of repairs or substitute for the automobile, as well as any medical costs and lost incomes.

Lower costs than a PPO offered by the exact same insurer, Any kind of in the EPO's network; there is no protection for out-of-network suppliers. This is the expense you pay each month for insurance coverage. Some EPOs may have a deductible. A copay is a level cost, such as $15, that you pay when you obtain care.

Term insurance coverage gives protection for a specific time period. This period could be as brief as one year or provide insurance coverage for a details number of years such as 5, 10, twenty years or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance mortality tables.

What's included: money to change a part of your earnings, or shut the space between your job coverage, if you're ever before too unwell or harmed to function. Best for: people (even stay-at-home moms and dads), physicians, dental practitioners, local business owner, and companies that intend to protect their revenue, career, or employees.

Joint Life insurance policy provides insurance coverage for 2 or more individuals with the death advantage payable at the very first fatality. Costs are substantially more than for policies that guarantee one person, since the probability of needing to pay a death case is higher. Endowment insurance policy attends to the payment of the face amount to your beneficiary if fatality occurs within a specific time period such as twenty years, or, if at the end of the certain period you are still to life, for the payment of the face total up to you.

Fully comprehensive cover is the highest degree of insurance coverage you can have. It includes all the cover of a third-party fire as well as burglary plan, yet also secures you as a driver, and also may pay for damage to your very own cars and truck. You could be curious about this useful overview by Cash, Assistant to picking the ideal degree of automobile insurance coverage.

2% of the American population was without insurance coverage in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health And Wellness Stats. Greater than 60% got their insurance coverage with an employer or in the exclusive insurance coverage industry while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, professionals' benefits programs, and the federal market established under the Affordable Treatment Act.

0% of your home mortgage amount. If you have area on your credit line, you could take the amount you need to reach your 20% down payment and also stay clear of paying the mortgage default insurance.: Will you require home loan default insurance? Maintain checking out the path to own a home and also learn.

According to the Social Security Administration, one in four employees entering the workforce will end up being disabled prior to they reach the age of retirement. While health insurance policy pays for a hospital stay and medical costs, you are typically burdened with all of the expenditures that your paycheck had actually covered.

If these quotes transform in later years, the business will adjust the premium appropriately but never ever above the optimum ensured costs stated in the policy. An economatic entire life policy provides for a fundamental quantity of getting involved entire life insurance policy with an extra supplemental protection supplied through making use of rewards.

Employer protection is often the ideal option, however if that is unavailable, get quotes from numerous providers as several offer discount rates if you buy greater than one type of protection.

Selecting the best type of coverage depends on your preferred degree of defense as well as your budget. A fundamental, no-frills commuter automobile might be your finest option.

Throughout the years, these divisions have actually come under fire in lots of states for being inefficient as well as "slaves" of the market. Big insurance providers run in all states, and also both they as well as customers must contend with fifty various state regulatory plans that give extremely various levels of defense. Once in a while, attempts have actually been made to bring insurance policy under federal guideline, yet none have been successful.

Today, a lot of insurance coverage is available on a bundle basis, with solitary plans that cover one of the most important threats. These are frequently called multiperil policies. Insurance is a requirement for every United States organization, as well as several businesses operate in all fifty states, regulation of insurance coverage has continued to be at the state level.

Given that they do not offer any cash value, they are typically available at a much lower premium than other items for the same quantity of protection. If the Life Assured passes away during the policy term, the nominee receives the Sum Assured, as well as there is no maturity worth if the Life Assured endures the plan term.

While there are no government or state needs for property owners insurance, home loan loan providers normally need it as a condition for accepting a loan, guaranteeing that their investment is secured. The monetary advantages of property owners insurance policy are many. It covers the cost of fixing or rebuilding your house in the occasion of damage and also replacing personal valuables when it comes to theft or destruction.

Usually family members plans are marketed in devices (packages) of security, such as $5,000 on the major wage earner, $1,500 on the partner and also $1,000 on each kid. Joint Life as well as Survivor Insurance offers insurance coverage for 2 or even more persons with the survivor benefit payable at the death of the last of the insureds.

Occasionally, there is no relationship between the size of the cash money worth as well as the costs paid. It is the cash worth of the plan that can be accessed while the policyholder lives. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the current table used in computing minimum nonforfeiture worths and policy reserves for common life insurance policy plans.

When you have a deductible, you are accountable for paying a certain amount for insurance coverage services before your health strategy gives protection. Life insurance policy can be split right into 2 main kinds: term as well as permanent. Term life insurance gives insurance coverage for a certain period, typically 10 to three decades, and is extra economical.

Searching for a luxury ride? All the bells and also whistles will get you there comfortably, yet you'll spend for it. Let's take a closer look:: This type of plan supplies a very little level of insurance coverage for your home, covering just stated dangers like fire, wind, burglary and also criminal damage.